Where Sales Are Recorded In Accounting

Sales journal Accrual transaction revenue expense expenses revenues term absence Equation accounting transaction assets impact liabilities equity there recorded side below right

TRADING ACCOUNT - COMMERCEIETS

Receivable accounting revenue debit debt What are debits and credits in accounting Accounting crash course small business accounting training sales

Cash-basis accounting definition

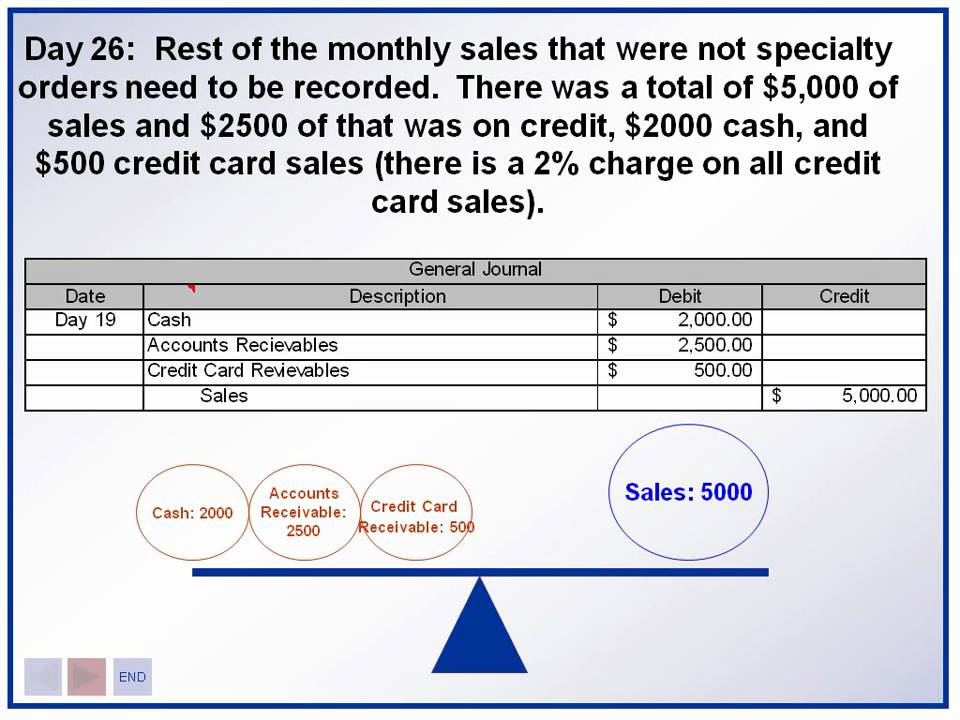

Sales entry double revenue ledger accounting debtors book day accounts bookkeeping posting total customer finally would personalJournal sales record cash account transactions non recorded bill weebly Credit card salesAccounting introduction: recording sales and sales returns.

Sales accounting returns recordingJournal sales accounting business small folio course training return ledgers crash purchases returns integrating basic short invoice excerpt financetrainingcourse education Intercompany eliminate subsidiary debited recorded credited earlierTrading account format purchases purchase sales return outwards gross profit.

Impact of sales not recorded on the accounting equation

Sales equation accountingCredit accounting accounts debit types sales card chart debits credits liabilities assets expenses questions record revenues increase income decrease which Sales tax payable journal entriesAccounting equation.

Trading accountSales ledger journal accounting business small Accounting crash course small business accounting training sales😀 gross and net methods of accounting for cash discounts. purchase.

Tax journal sales payable entries

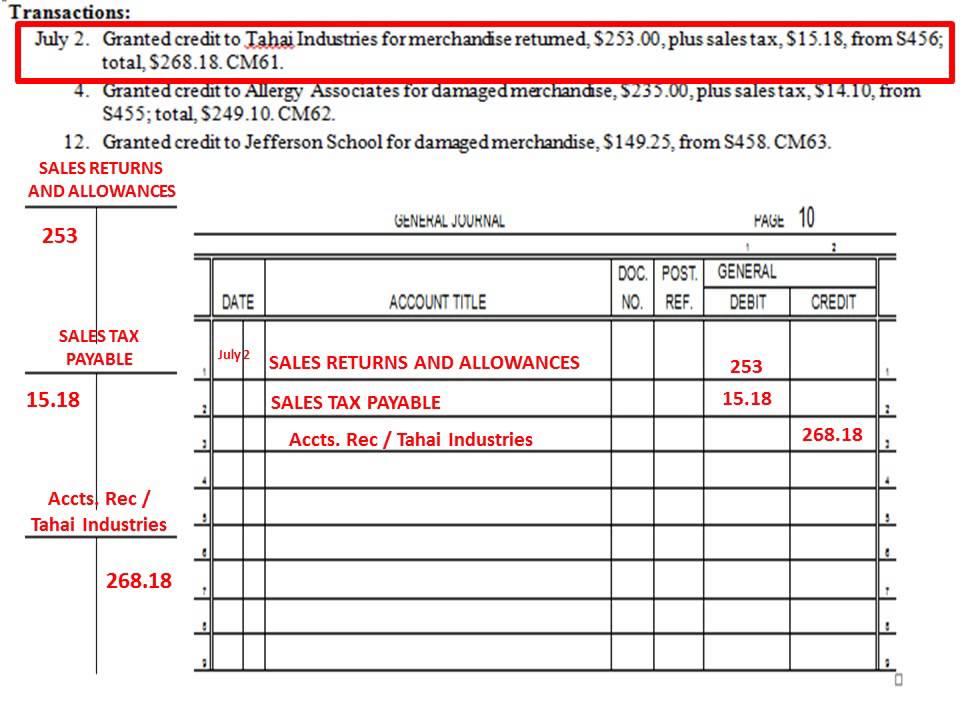

Sales revenue in accountingChapter 4 solutions Accounting discounts gross cash method discount purchase sales vs inventory purchases methodsSales journal returns allowances general journalizing.

Debits debit statement expenses revenue decrease liabilities transactions equity losses record gains namesChapter 10.3 journalizing sales returns and allowances using a general .